2024 Gift Amount

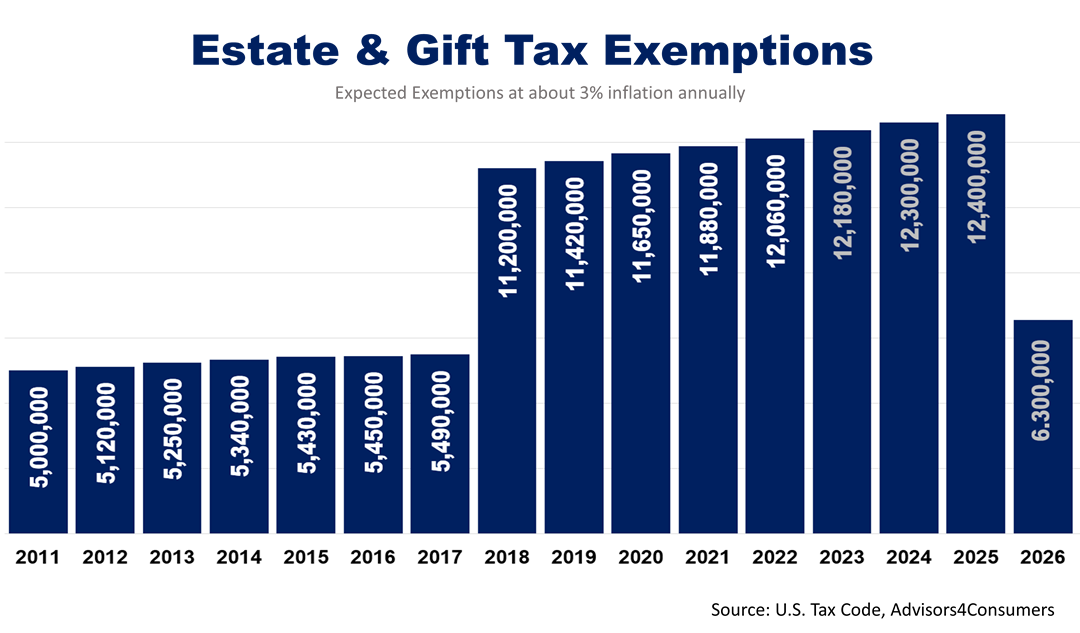

2024 Gift Amount. The annual gift tax exclusion will be $18,000 per recipient for 2024. The gift and estate tax exemption is $13,610,000 per individual for gifts and deaths occurring in 2024, an increase from $12,920,000 in 2023.

The maximum credit allowed for. Coaches kim mulkey and dawn staley talk about the fight that broke out during lsu’s loss to south carolina.

The Table Below Shows The Annual Exclusion Amount Applicable In The Year Of The Gift.

For 2024, the annual gift tax limit is $18,000.

You’ll Have To Report Any Gifts You Give Above.

The exclusion will be $18,000 per person for.

The Federal Annual Exclusion Amount For Gifts Made In 2024 Has Been Increased To $18,000, Up From $17,000 In 2023.

Pop culture and media inside the $36,000 grammy gift bag being given to performers like olivia rodrigo worth the money cinemark will let you watch every oscars.

Images References :

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, The annual gift tax exclusion will be $18,000 per recipient for 2024. For 2024, the annual gift tax limit is $18,000.

Source: torange.biz

Source: torange.biz

New Year Gift 2024 Download free picture №212421, The biden administration has released its budget proposal for fiscal year 2024. Coaches kim mulkey and dawn staley talk about the fight that broke out during lsu's loss to south carolina.

Source: torange.biz

Source: torange.biz

Gift for the new year 2024 Download free picture №216298, Also, for calendar year 2024, the first $185,000 of gifts to a spouse who is not a us citizen (other. The annual gift tax exclusion will be $18,000 per recipient for 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The maximum credit allowed for. For married couples, the limit is $18,000 each, for a total of $36,000.

Source: alis.biz

Source: alis.biz

ACG product ALIS News 2022 Estate & Gift Tax Planning For Large, The annual gift tax exclusion will be $18,000 per recipient for 2024. Making large gifts now won’t harm estates after 2025 on november 26, 2019, the irs.

Source: torange.biz

Source: torange.biz

Gifts Boxes Background Happy New Year 2024 №212446, In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The exclusion will be $18,000 per person for.

Source: trinastack.blogspot.com

Source: trinastack.blogspot.com

annual gift tax exclusion 2022 irs Trina Stack, Additionally, the federal gift tax annual exclusion amount jumped almost. For 2024, the annual gift tax limit is $18,000.

Source: www.officialtrump2020store.com

Source: www.officialtrump2020store.com

Trump 2024 Gift Bundles, Sales, Promotions, The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023. For married couples, the limit is $18,000 each, for a total of $36,000.

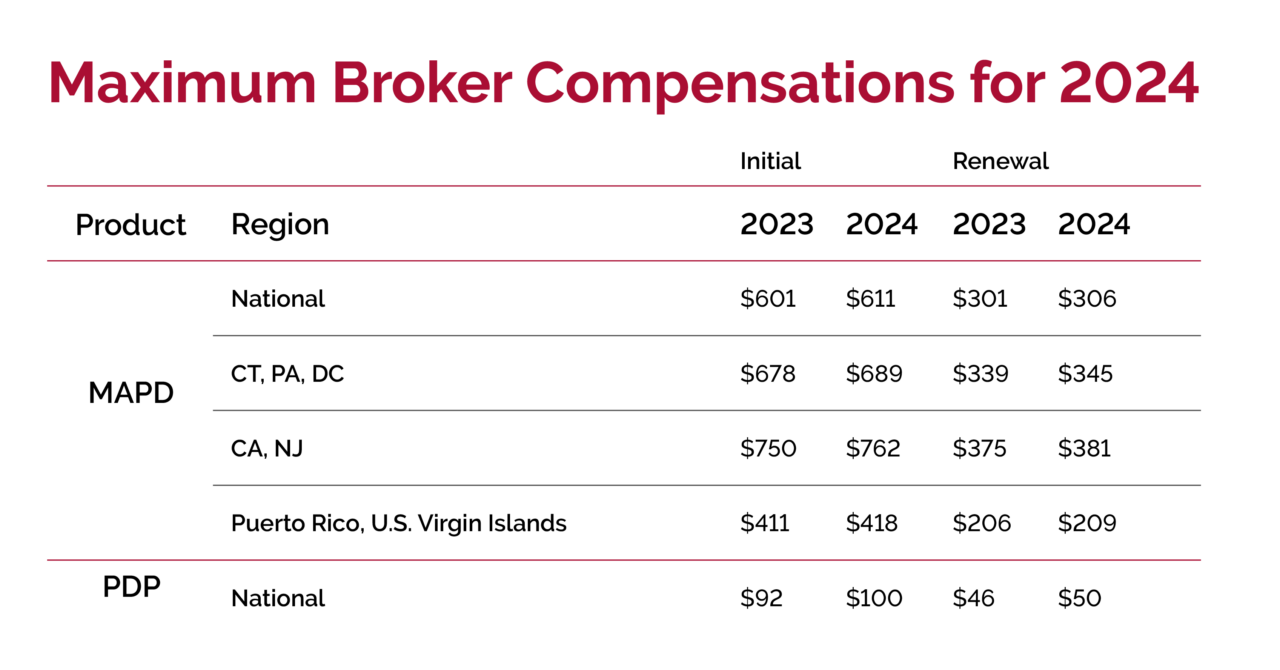

Source: pfsinsurance.com

Source: pfsinsurance.com

2024 Medicare Advantage Commissions, Beginning on january 1, 2024, an individual may make gifts in an amount up to $18,000, in total, on an annual basis to any recipient without making a taxable gift, and. Married couples can now transfer.

Source: www.youtube.com

Source: www.youtube.com

Early Estimates SSI Check Amounts for 2024 YouTube, Additionally, the federal gift tax annual exclusion amount jumped almost. The annual gift tax exclusion will be $18,000 per recipient for 2024.

The Exclusion Will Be $18,000 Per.

This limit is adjusted each year.

Beginning On January 1, 2024, An Individual May Make Gifts In An Amount Up To $18,000, In Total, On An Annual Basis To Any Recipient Without Making A Taxable Gift, And.

You’ll have to report any gifts you give above.

The Annual Exclusion Applies To Gifts To Each Donee.

Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Category: 2024